by Richard Keyt and Richard C. Keyt, Arizona LLC attorneys who have formed 9,800+ Arizona LLCs and have 280 five-star Google reviews and a total of 398 five star online reviews because people love their lost cost LLC formation services that includes same day filing and approval and a confidential LLC that keeps owner’s name and address off of the public records.

This Article Explains Creating an LLC in Arizona & How to Form an LLC in Arizona Online

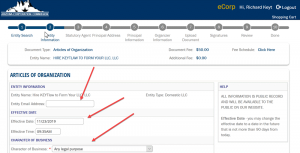

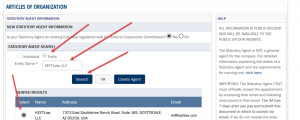

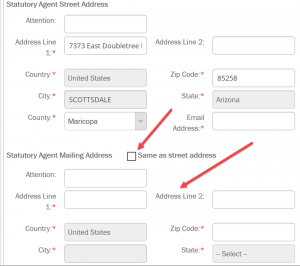

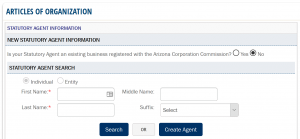

Read this article to learn how to form a do-it-yourself Arizona LLC by creating an LLC in Arizona online. Follow the detailed step-by-step guide with pictures below that explain each of the 10 steps needed to form a new Arizona LLC or PLLC online using the ACC’s online eCorp LLC formation system. The end result is you will have formed an Arizona LLC and received a one-page document called the Articles of Organization.

See also our How to Form an LLC in Arizona FAQ in which we answer frequently asked LLC in Arizona questions.

What You Get If We Form Your LLC Arizona

If you form an Arizona LLC online all you get is the LLC and a one page document called Articles of Organization. Compare that to the 9 (Bronze LLC), 15 (Silver LLC) & 21 (Gold LLC) services we give you if you hire us to form an AZ LLC. See the contents and prices of our three LLC formation packages. Our Gold LLC is a confidential LLC that keeps your name and address off of the public records of the Arizona Corporation Commission and it includes a revocable living trust that leaves the LLC and other assets you put in the trust to your loved one automatically on your death without the need for a probate.

How to Hire Us to Form an AZ LLC

To hire us to form your new Arizona LLC with a new Arizona LLC law-compliant Operating Agreement, do one of the following:

Option 1 Online: Complete and submit our LLC formation questionnaire.

Option 2 Phone Call: Call one of the following Arizona LLC attorneys to get free answers to your questions and give him your LLC information:

- Richard Keyt (father) – 480-664-7478 or make a free office or phone appointment using his online calendar at www.keytlaw.com/rk

- Richard C. Keyt (son) – 480-664-7472 or make a free office or phone appointment using his online calendar at www.keytlaw.com/rck

Ten Steps to Form an LLC in Arizona Online in 10 Minutes

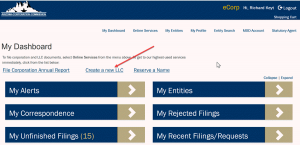

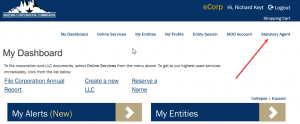

After registering and creating an account with the Arizona Corporation Commission, follow the 10 steps below to form your LLC. Each step is explained in detail. Click on a step to go directly to that step.

Click on a + symbol below or the text to the right of the + symbol to open a section to read the information in the section. To close a section that is open click on the – symbol or the text to the right of the – symbol.

Warning: All Arizona LLCs Need an Operating Agreement

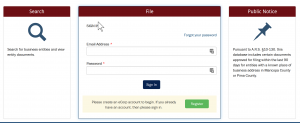

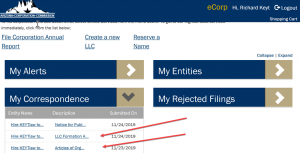

Step 0. Create an Account with the Arizona Corporation Commission or Login

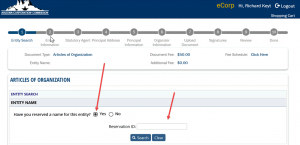

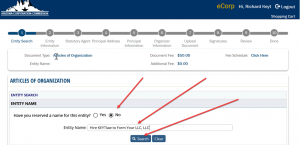

Step 1. Entity Search

Step 2. Entity Information

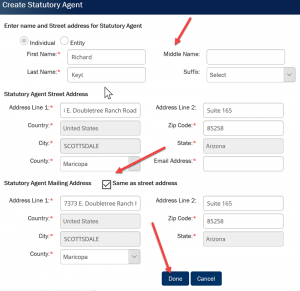

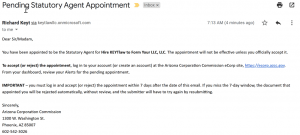

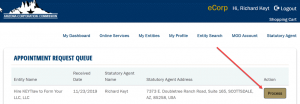

Step 3. Statutory Agent

Step 4. Principal Address

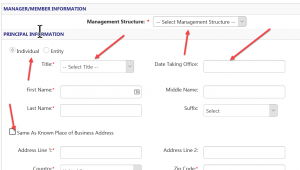

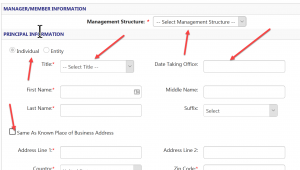

Step 5. Principal Information

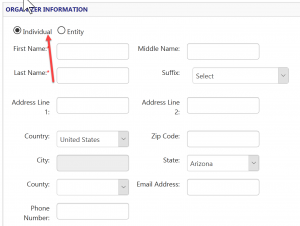

Step 6. Organizer Information

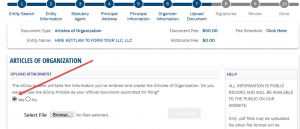

Step 7. Upload Document

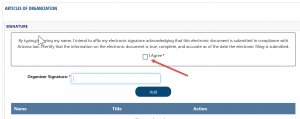

Step 8. Signatures

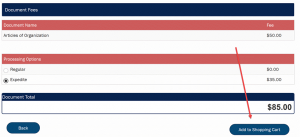

Step 9. Review

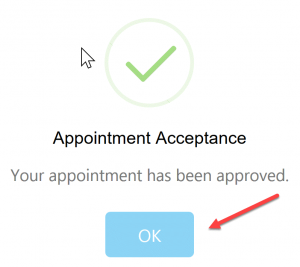

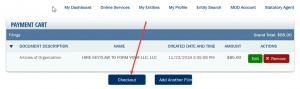

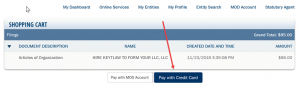

Step 10. Done

Important Tasks to Perform After Forming Your LLC or PLLC

There are several important tasks that you should complete after forming your new LLC or PLLC. To learn more see our article called “Important Post LLC Formation Tasks.”

How to Hire Us to Form an Arizona LLC

100% SATISFACTION GUARANTEED

If you hire us and are not happy we will refund your LLC formation fee less the filing fee. Nobody, repeat nobody will give you as much as we will give you if you hire us to form a Silver or Gold LLC. Take a couple of minutes and list below to see the many services we give you when we form an Arizona LLC.

If you hire us and are not happy we will refund your LLC formation fee less the filing fee. Nobody, repeat nobody will give you as much as we will give you if you hire us to form a Silver or Gold LLC. Take a couple of minutes and list below to see the many services we give you when we form an Arizona LLC.

We’ve made it very easy to hire Richard Keyt who has formed 9,800+ Arizona LLCs and has 280 five star Google reviews and a total of 398 five star online reviews. It’s a simple 5 – 10 minute process. To hire Richard Keyt to form your new Silver ($897) or Gold ($1,397) LLC select one of the following two options:

Option 1 – Telephone

Call Richard the father or the son and give them your LLC and credit card information over the phone:

- Richard Keyt (father) – 480-664-7478 or book a free phone, office or Zoom consultation with him.

- Richard C. Keyt (son) – 480-664-7472 or book a free phone, office or Zoom consultation with him

Option 2 – Online

Complete our LLC Formation Questionnaire and click on the submit button at the end. Our system will email the completed Questionnaire to the email address you specify in the Questionnaire so you can review the information to make sure everything is correct.

How to Hire Us to Prepare a Custom Operating Agreement for an Arizona LLC

If we don’t form your Arizona LLC, you should hire us to prepare a custom Operating Agreement for $297 for a single-member LLC or a married couple LLC or $797 for a multi-member LLC by submitting our Operating Agreement Preparation Questionnaire.